Are you a Canadian who is tired of paying your current mortgage every month? Have you considered refinancing your home mortgage but want to free up some money to de-stress your monthly payments?

Fortunately, if you’re a Canadian homeowner, there’s another option for refinancing: cash-out refinance. With cash-out refinance, you can get the extra cash that you need to pay off high-interest debts or upgrade your home.

Now let’s take an in-depth look at what cash-out refinancing means in Canada and how it works. In this article, I will provide an overview of cash-out refinancing. I will also discuss details on requirements and application processes specific to Canadians.

In a nutshell, this article discusses:

- Cash-out refinance involves borrowing cash from the lender and paying off debt by adding the borrowed amount to one’s mortgage.

- In cash-out refinancing, you can immediately get the money, have lower interest rates, and set your payment terms.

- Drawbacks of cash-out refinance include extra expenses and the risk of foreclosure. You will also potentially pay higher mortgage interest rates.

- If you’re considering a cash-out refinancing, then it’s important to take the necessary steps in preparation.

What Is A Cash-Out Refinance?

In essence, cash-out refinance is an application for a bigger loan in exchange for immediate cash. With this type of refinancing, you’re borrowing cash from your lender. You’re also asking them to allow you to pay your debt through adding the borrowed amount to your original mortgage.

People apply for cash-out refinancing for several reasons. Some of these include paying tuition fees, high-interest debts, home renovations, or new investments. Most of the time, borrowers need immediate additional money to pay off something important.

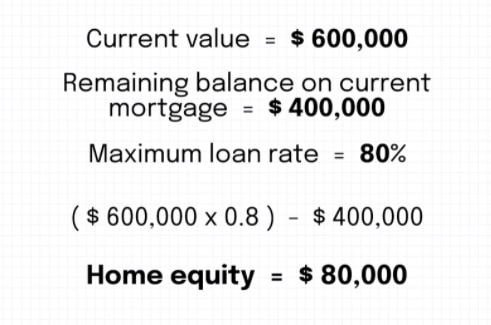

You can secure up to 80% of your residence’s current value, minus the remaining balance of your mortgage. This is also called home equity.

In this example, you can cash out a total of up to $80,000. Just keep in mind that your new mortgage will amount to $480,000 plus interest.

Mortgage Renewal vs. Refinance

Simply put, mortgage renewal involves renewal of your current mortgage with your existing lender. Refinancing, on the other hand, may involve renegotiating the interest rate with another lender.

Mortgage renewal is often more appealing than refinancing as it costs less money and has fewer risks involved. Renewing your mortgage means that you don’t have to pay fees. You also get to keep the same mortgage lender. So, there will be no worries about completing new paperwork or providing extra documents to jump through hoops with the bank.

Whereas, refinancing gives you an opportunity to switch lenders and potentially secure better terms on your loan. This is done by negotiating for a lower interest rate or better loan options from another lender. Refinancing can help save you thousands over the life of your loan. But it requires careful consideration since there are costs associated with closing out the old loan early to pay off the new one.

Benefits of Cash-Out Refinance

Immediate Cash-Out

Once you’re approved for a for cash-out refinancing, the amount is immediately deposited into your account. You can then use the money as you wish.

This provides a great advantage to those who need to pay off debts or make investments quickly. They don’t have to worry about waiting for a lengthy approval process. Also, cash-out refinance provides you with a lump sum payment, which is much more convenient than having to make multiple payments on debts.

Lower Interest Rates and Constant Payments

If the rates have dropped since you first applied for your mortgage, cash-out refinancing can help you have lower interest rates. In turn, you could also get lower monthly mortgage payments.

Since most cash-out refinances work on a fixed rate, you’ll be paying the same amount for the whole duration of your mortgage. There are no surprises compared to mortgages with variable rates. If applied at the right time, fixed-rate mortgages can also give you lower interest rates overall.

Get in touch with a realtor to help you find the best time to apply for a cash-out refinance mortgage.

Freedom to Choose Payment Terms

Because applying for a cash-out refinance is the same as applying for a new mortgage, you once again get the freedom to set your payment terms.

If your financial situation has changed since you first applied for a mortgage, it may be advantageous to update your mortgage terms. By doing so, you can get more favourable conditions.

Set the amount you’ll be paying monthly and the duration with which you’ll be paying for your new mortgage. Once your cash-out refinance application gets approved, these new terms will kick in and be more convenient for you.

Non-Taxable

It’s important to remember that any money received from this process will NOT be classified as taxable income. This isn’t necessarily beneficial since all debt must eventually be repaid. But, keep in mind that by taking advantage of a cash-out refinance on your home, you won’t have to worry about being taxed when filing your taxes when the year ends.

Drawbacks of Cash-Out Refinance

Additional Expenses and Duration

Cash-out refinance mortgage isn’t free. Applying for a new mortgage incurs closing costs that are about 3–6% of the total price of your home. These include home appraisals and inspections done by the lender as part of processing your loan application.

Applying for a cash-out refinance basically adds to your current mortgage. You’ll have to pay a larger amount or for a longer period of time. In most cases, it’s both.

Interest Rates

If cash-out refinance is done at a time when rates are high, you’ll end up paying more than the interest rates for your current mortgage. This might also make your mortgage harder to afford and pay off.

So, it’s important to discuss with a realtor to know whether cash-out refinance is right for you.

Risk of Foreclosure

Because cash-out refinance isn’t always the right way to go, you risk having your home up for foreclosure. Some people get approved for a cash-out refinance, but they end up being unable to pay for their new mortgage. This is especially true if the cash-out was used for unnecessary expenses or failed investments.

Financial conditions may change anytime, so you might actually end up defaulting on your mortgage. It would be best if you plan for things like this in advance, even before applying for cash-out refinance, so that it doesn’t take you by surprise later on.

If you’re not confident with being able to handle a cash-out refinance but need money right away, you have two options to consider:

With these, you won’t have to deal with mortgages.

Preparing for A Cash-Out Refinance: Tips and Guidelines

1. Assess Your Home Equity

Before you consider refinancing, it is important to assess your current home equity situation. Just like any other financial decision, it’s important to understand how much equity you already have in your home. You should also know whether or not you’d be able to use that equity to access funds for a cash-out refinance. That being said, it’s important to get an updated appraisal of your property before you apply for a refinance.

2. Gather Documentation

Cash-out refinances involve more paperwork than traditional mortgages. So, be sure to gather all necessary documentation before beginning the application process. This includes copies of:

- recent mortgage statements

- bank statements

- tax returns

- credit reports

3. Check Different Lenders and Rates

Like any other kind of loan product in Canada, there are different lenders who offer cash-out refinancing options. These lenders have varying rates and terms, so be sure to shop around and find the best rate possible. Here are a few extra steps you can take to increase your chances of finding the most attractive offers:

- Conduct a quick online search to explore cash-out refinancing options.

- Consider comparison shopping to find the best offers available.

- Leverage mortgage broker relationships to potentially access exclusive deals.

4. Get Prequalified to Better Understand Your Options

Getting prequalified by a lender can give you an idea of exactly which kinds of refinance products you may qualify for. You’ll also learn what specific terms those loans will carry, such as interest rates, repayment periods, and more. Prequalification generally requires only a few simple steps. These include submitting documents along with basic information, such as proof of income. So, it’s worth taking the time to understand all financing options upfront before making any decisions.

5. Be Prepared to Pay Closing Cost Fee

Most lenders typically require closing cost fees for cash-out refinances. This fee is used to cover expenses related to paperwork, inspections, and other services. Depending on your specific lender, you may also be responsible for paying processing costs like title searches. Make sure to ask your lender about all applicable fees before refinancing.

6. Know the Exact Amount of Cash You Will Receive after Fees and Costs Paid

You should always take the time to crunch some numbers and figure out how much cash you will receive after all closing costs and fees are paid. Talk with your lender to get an exact figure so that you can plan accordingly. The last thing you want is to be left with less cash than initially anticipated.

7. Monitor Your Credit Reports Regularly after Refinancing

Your credit history and score are important factors when it comes to getting approved for a loan. As such, it’s important to check your credit reports after refinancing to make sure everything is accurately reflected. Doing so can help you catch any discrepancies that may have been made by the lender during the application process.

Where to Learn More about Cash-Out Refinancing?

For more information on cash-out refinancing in Canada, the first place to look is the CMHC website. This resource offers guides and provides explanations for Canadians who are looking for ways to:

- manage their debt

- consolidate loans

- use their home’s equity to their advantage

You can also consider signing up for a credit counseling agency. Doing so will provide you with the opportunity to speak directly with credit advisors and review your options.

Additionally, CMHC has a blog containing information on mortgages and leveraging your home equity. You can read this blog as well as consult news sources which are dedicated to housing-related matters. They often feature articles on cash-out refinancing insights.

The Bottom Line

Like all other refinancing methods, cash-out refinance has its advantages and risks. Seek professional advice before making any move to reduce your risk of losing your hard-earned money.

As much as possible, use cash-out refinance to pay off a debt in which the repayment would lessen your monthly expenses. It’s good to invest in something that would increase your income. People sometimes use cash-out refinance to pay for home renovations that increase their home value.

Remember that there are other options to go for, such as home equity line of credit and home equity loans. Make sure you do some research to find the best choice for you before buying a home.

Again, here are the things to take note of when applying for a cash-out refinance in Canada:

- It provides immediate cash out that is helpful if you have an urgent expense to take care of.

- It could yield lower interest rates than your current mortgage. However, it could also cause you to pay more. Ask for professional help from a realtor to make sure you’re doing it at the right time.

- You can set new payment terms for your new mortgage. This helps you manage your finances better.

- Cash-out refinance adds to your current mortgage. Make sure you account for the changes that this might bring to your finances.

- You risk losing your home to foreclosure when you start defaulting on your new mortgage. Prepare everything you need before applying for a cash-out refinance to make sure you’ll be able to handle it.

If buying a home in Airdrie is one of your reasons for a cash-out refinance, we’ll help you make the most out of it. Our expert realtors in Airdrie will help you find the perfect home for your needs and get the best terms.