“Is the Calgary market finally shifting in favour of buyers?” Let’s break it down.

For the first time in years, Calgary is seeing a meaningful shift in market dynamics—and if you’re a buyer waiting for your window of opportunity, it might be cracking open.

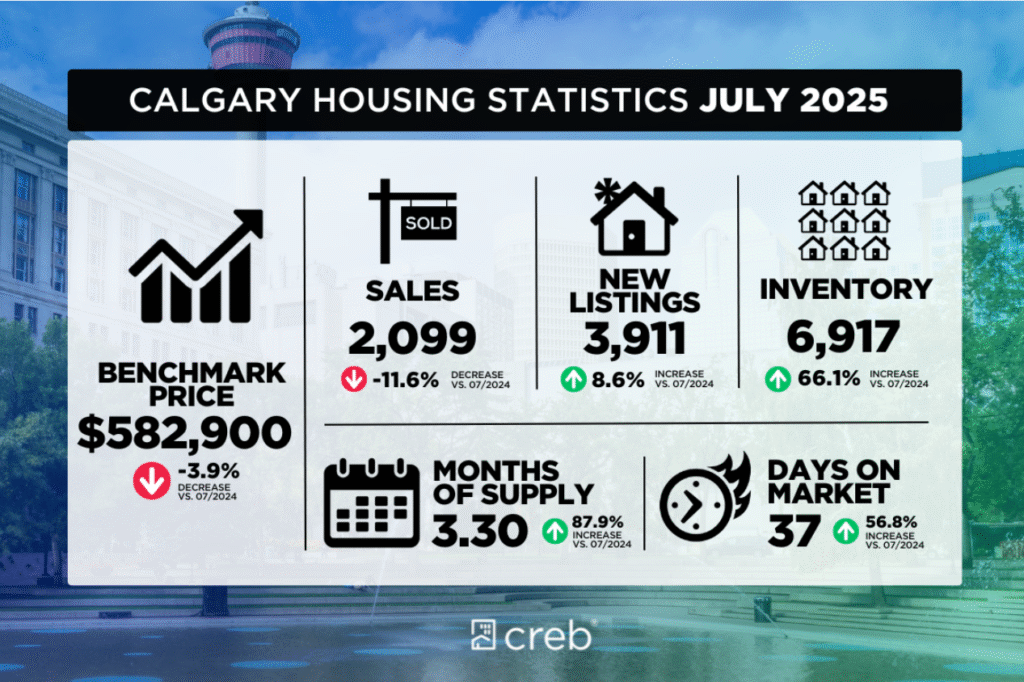

Inventory levels hit 6,917 units in July, a number not seen since before the pandemic. Thanks largely to aggressive new builds in developing communities, supply is finally catching up to demand. While this doesn’t mean prices are crashing—it does mean buyers have more choices, and sellers need sharper strategies.

Prices Are Cooling—but Not Crashing

The benchmark price for all residential property types in Calgary dipped to $582,900, marking a 4% drop from last year’s June peak. But don’t panic—this doesn’t mean values are vanishing.

The biggest price drops are happening in row and apartment-style homes, particularly in the North East and North districts. Why? These areas are flooded with fresh inventory, giving buyers more negotiating power.

“Price declines are not occurring across all property types or locations. Even where there have been declines, we’re still well above pre-pandemic values.” – Ann-Marie Lurie, CREB® Chief Economist

Sales Are Slowing

There were just 2,099 sales in July—down 12% from the same time last year. Meanwhile, new listings jumped by 8%, creating the breathing room Calgary buyers have been begging for.

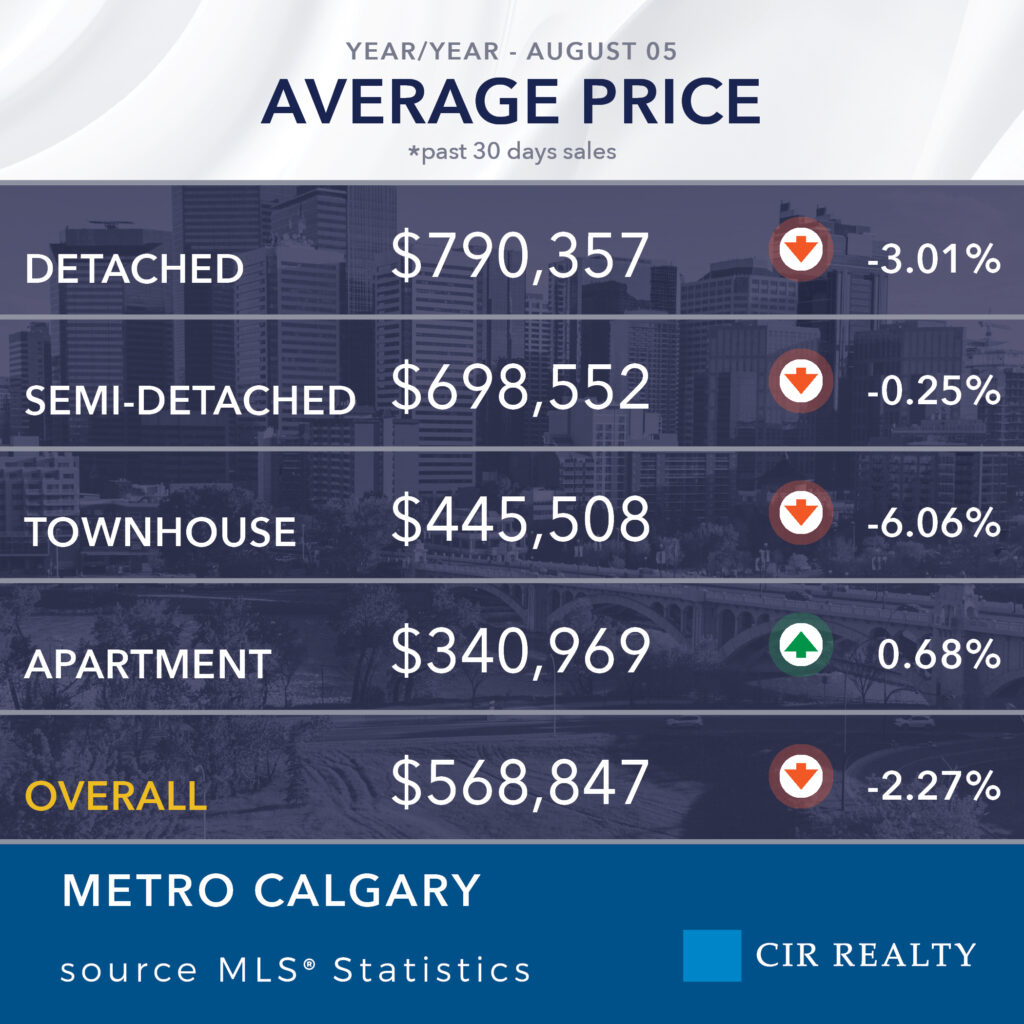

Here’s what that looks like by property type:

- Detached Homes: Benchmark at $761,800, down just 1% YoY. Balanced conditions with 3 months of supply.

- Semi-Detached: Benchmark at $697,500, actually up 1% YoY. Still showing strength.

- Row Homes: Benchmark at $446,200, down 4%. More supply = more negotiating power.

- Apartments: Benchmark at $329,600, down 5% YoY and over 1% from last month alone.

What’s Happening in the Districts?

Not all districts are created equal—some are softening, others are still seeing gains:

- City Centre: +4.1% YoY – Resilience in high-demand urban zones.

- West Calgary: +7.4% YoY – Strongest appreciation across the board.

- North East: -7.2% YoY – Inventory surge is driving prices down.

- East Calgary: -2.7% YoY – One of the softest submarkets for sellers.

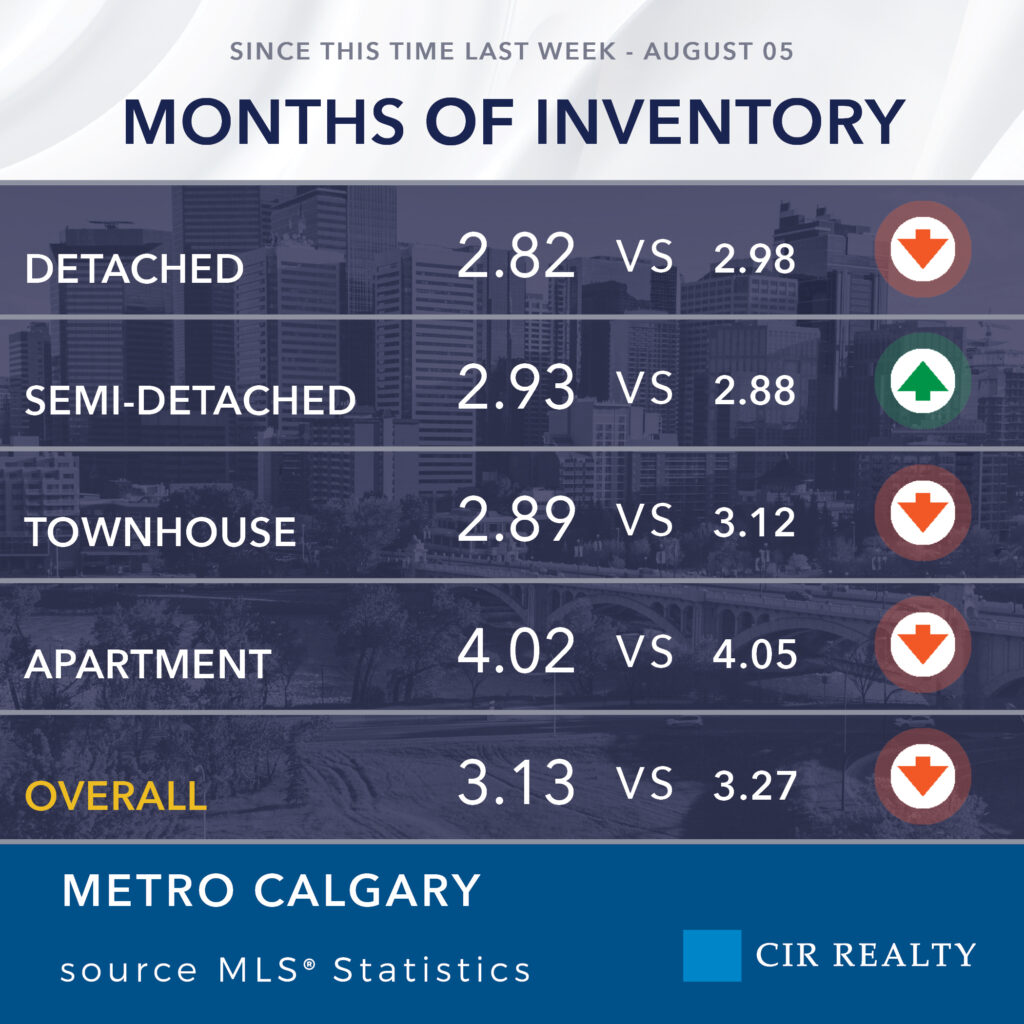

Buyer-Seller Balance: The Tipping Point

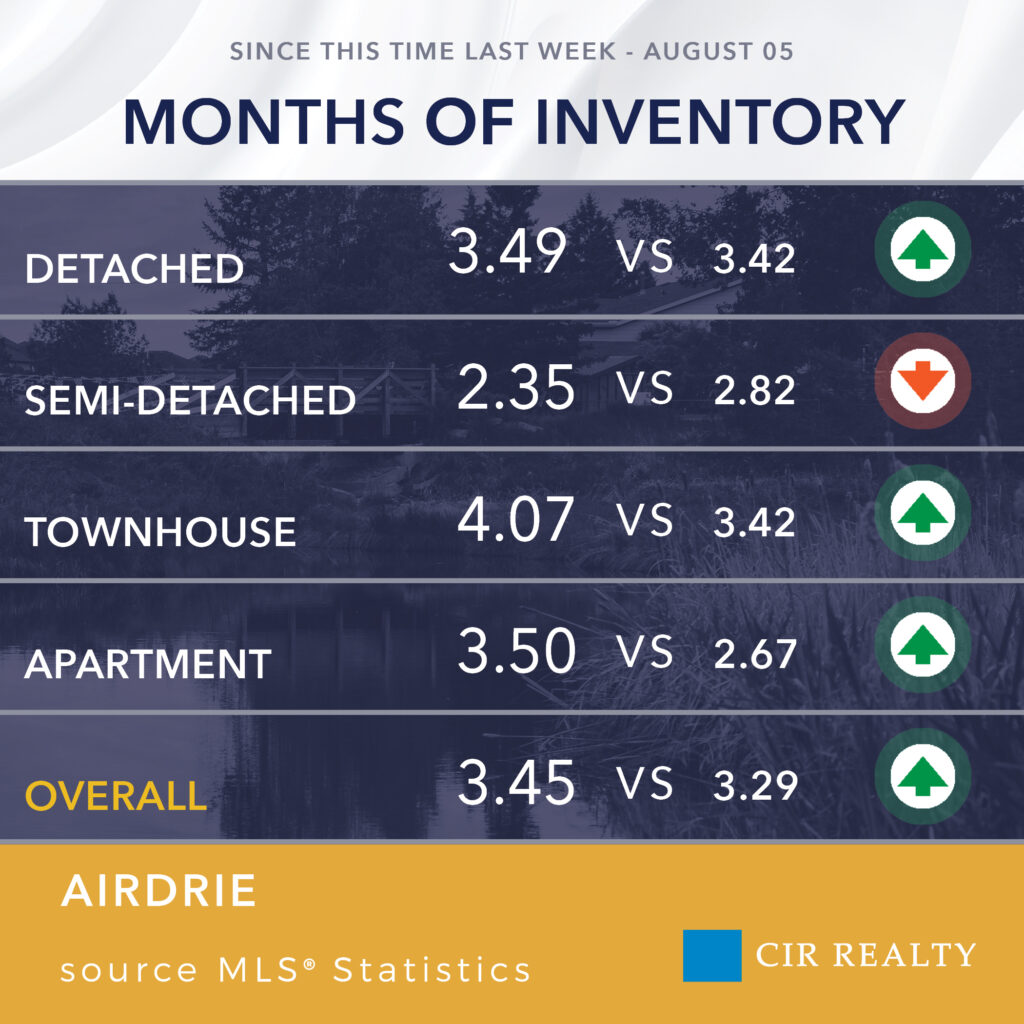

The months of supply metric—a key gauge of market balance—is telling:

- Apartments: 4.13 months (firmly in buyer’s territory)

- Row Homes: 3.2 months

- Detached & Semi-Detached: Both sitting around 3 months (balanced)

This signals a clear shift from the seller-dominated chaos of recent years toward a more balanced (and even buyer-friendly) playing field.

What This Means for You

Sellers:

It’s time to ditch the “list it and forget it” mindset. Pricing strategy, professional marketing, and expert negotiation are more important than ever. Homes in oversupplied districts need to stand out—or sit.

Buyers:

You’ve waited, and now the tide is slowly turning in your favour. More choice, more leverage, and fewer bidding wars—especially if you’re looking at condos or row homes.

Final Thoughts

The Calgary market is evolving. We’re not heading into a crash, but a correction—especially in high-supply areas. If you’re thinking about buying, selling, or investing, you need a guide who knows how to navigate the nuances of a shifting market.

Let’s talk strategy. Whether you’re ready to make a move or simply want to understand how this market affects your plans, I’m here to help. Contact us today to get started.